With regular budget tracking, you can always know how your business is doing. That means setting a time in your schedule each day or week to review the budget and track actual income and expenses, then compare the actual numbers to the estimates. Budget Monitoringįor larger businesses, you might delegate budget tracking to multiple supervisors, but even if you are a one-person show, you need to regularly monitor the budget. During this stage, you will also set spending limits and create a system to regularly monitor the budget. You can also create multiple budgets, some short-term and some long-term. The process all starts with properly preparing and planning the budget at the start of each month, quarter, or year. There are a few key components to managing your business budget to keep it healthy. It’s wise to create multiple savings accounts for emergencies and for money meant to go back into the business to drive growth. Either way, you need to review your budget after including all expenses, fixed costs, and variable costs to find out how much money you can save. Unexpected expenses might come up, or you might want to save to expand your business. While you may always need to pay some variable costs, like utility bills, you can also shift how much you spend toward things like advertising expenses when you have lower-than-average estimated income.

BUSINESS BUDGET PLANNING SOFTWARE

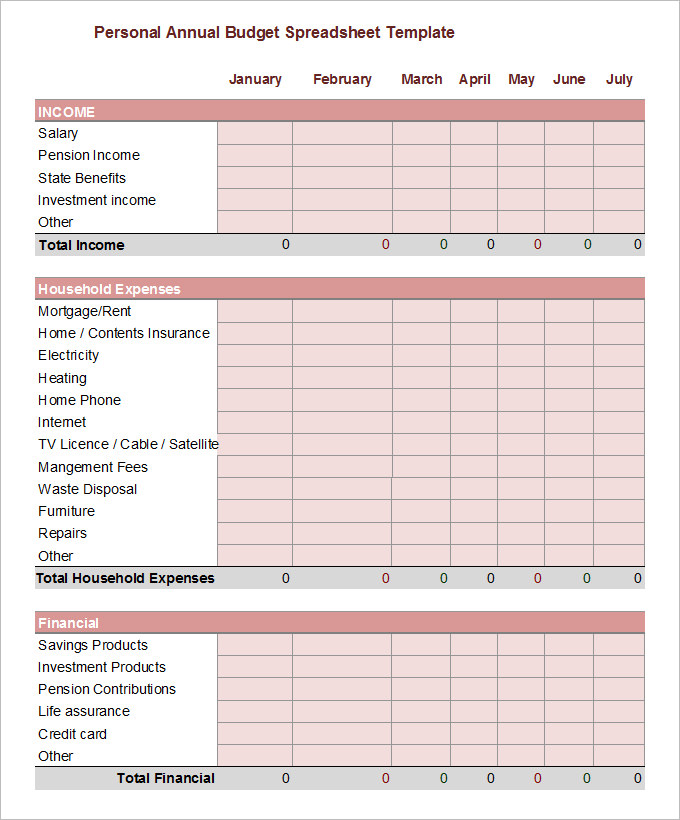

Examples include utility bills, advertising costs, office supplies, and new software or technology. Variable costs will change from time to time. Examples include insurance, rent for office space, website hosting, and internet. Subtract Fixed Costs for the Time Periodįixed costs are the recurring costs you have during each month, quarter, or year. For a new small business budget, you’ll rely on your market research to estimate the first revenues for your company. With a budget, you’re planning for the future, so you’ll need to estimate this based on previous months’ or years’ revenues. Once you have your template, you’ll start by listing all the sources of your business’ income. There are many free or paid budget templates online these days, so you can either use one of those to start, or make a simple spreadsheet with custom rows and columns based on your business. Here are the basic steps to creating a business budget.

BUSINESS BUDGET PLANNING HOW TO

How to Create a Business BudgetĬreating a business budget is a straightforward process, but it can be more complex for larger companies.

This could include employee salaries, office expenses, and software and technology costs. Then, you have your recurring expenses, which you would list as outgoing money. You’d list the estimated revenue from all of your business’ revenue streams as incoming money for the business.

BUSINESS BUDGET PLANNING PLUS

The business budget follows a set template, which you can fill in with estimated revenues, plus any recurring or expected business expenses.įor example, if you run a digital marketing business, you might know that you typically make about $10,000 for your work creating campaigns, plus an extra $5,000 for your digital courses. A business budget is a spending plan that estimates the revenue and expenses of a business for a period of time, typically monthly, quarterly, or yearly.

0 kommentar(er)

0 kommentar(er)