Revolut offers its financial products to more than 15 million clients in 35+ countries in Europe, Asia Pacific, and the Americas. Revolut aims at launching its payments and banking services across all 50 US states.

REVOLUT KASINO LICENSE

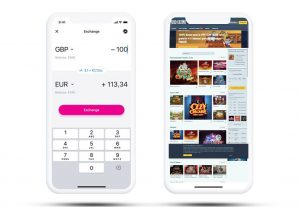

In March same year, Revolut submitted its application for the US banking license with Federal Deposit Insurance Corporation (FDIC) and California’s Department of Financial Protections and Innovation. The same year, Revolut signed a partnership deal with Mastercard to offer debit cards to the US market and launched the service in Japan.Īt the beginning of 2021, the company applied for a UK banking license. In 2020, Revolut also announced it adheres to the EU’s PSD2 Open Banking regulation allowing users to connect all their accounts in one place. In 2019, Revolut announced the company’s expansion into Singapore and Australia and a global deal with Visa. These certificates paved the way toward global success. Soon after, Revolut also obtained an Electronic Money Institution license from the Bank of Lithuania. In 2018, the company got a Challenger bank license from the European Central Bank, facilitated by the Bank of Lithuania. Having such enviable fintech experience, the two launched the start-up at the Level39 fintech incubator in London. Nikolay Storonsky was a trader at Credit Suisse and Lehman Brothers, while Yatsenko was a former developer at Deutsche Bank and Credit Suisse. Both Storonsky and Vlad Yatsenko had a substantial financial background. So, he decided to create a multi-currency payment platform that would allow travelers to make cheap conversions. He hated that he was throwing away so much money for nothing. Nikolay Storonsky was traveling a lot and was annoyed by the high conversion rates and transaction fees. The story behind Revolut is, actually, quite inspiring. Revolut is a UK-based fintech company founded in 2015 by Nikolay Storonsky and Vlad Yatsenko. If the payment service is cheap and safe, they’ll gladly give it a go. It’s no secret that casino players continually look for the most reliable and hassle-free banking method to top-up their casino balances. Hearing all this, it doesn’t surprise that Revolut has more than 15 million active users in 35+ countries across the globe. You can use a Saving Vault, Revolut Shopper, and take advantage of various special deals and cashback rewards. Revolut also features cryptocurrency services allowing you to buy and exchange cryptos into any supported fiat currency. You can use Revolut Visa and Mastercard branded cards or link your external bank accounts via Open Banking. Revolut is continually expanding its range of products and services. As they say, pay like a local with cheaper exchange rates. Finally, use Revolut for paying abroad by converting funds into 150+ currencies for a lower cost. Banks offer these rates to each other to swap currencies at more competitive rates. You can send money to other Revolut users worldwide, converting the funds into more than 30 local currencies with real-time interbank exchange rates.

0 kommentar(er)

0 kommentar(er)